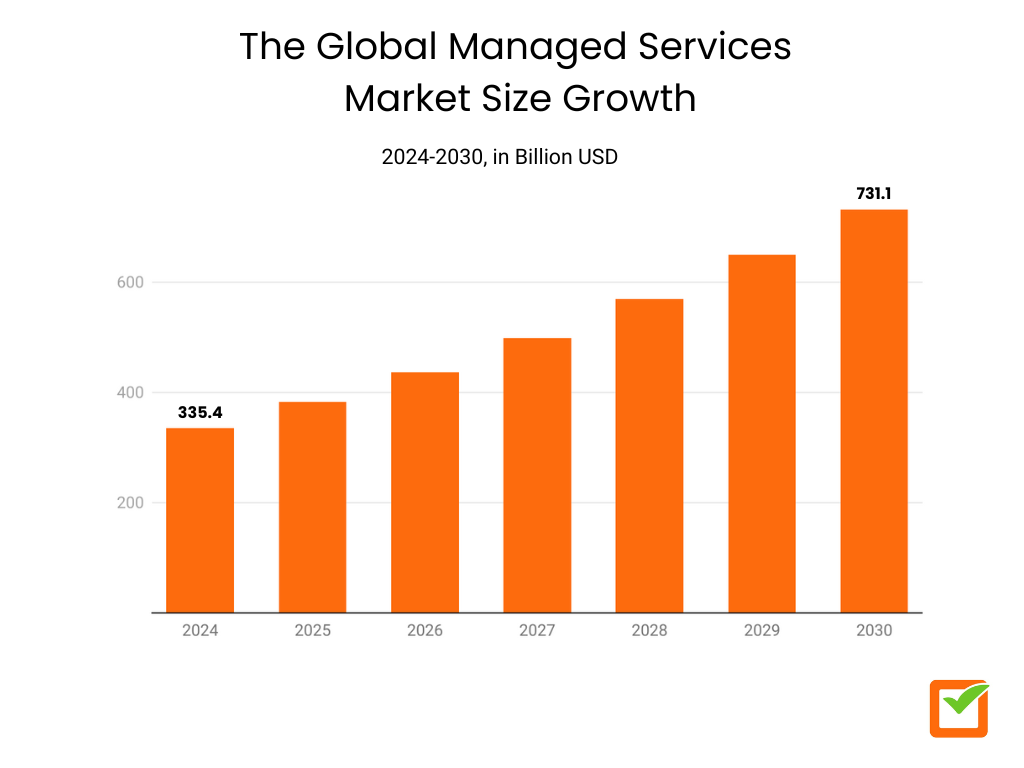

There are multiple ways to size the market (which we’ll compare next), but one widely cited view projects managed services to reach $731.08 billion by 2030. Buyer demand is strong: 93% of organizations use or are considering an MSP, and 35% now have an MSP fully manage IT, up from 29% just six months earlier. Meanwhile, AI-enabled threats, mounting security pressure, and expectations for true 24/7 reliability are reshaping how buyers evaluate providers and how MSPs run their operations.

This guide is intended for CIOs/CTOs, IT leaders, MSP owners, channel partners, and analysts who track the MSP space. We’re practitioners in the MSP market ourselves, so we pair hands-on context with rigor: every data point comes from reliable, up-to-date sources, and where the sources differ, we clearly interpret what that means for decisions in 2025.

Global MSP Market Overview

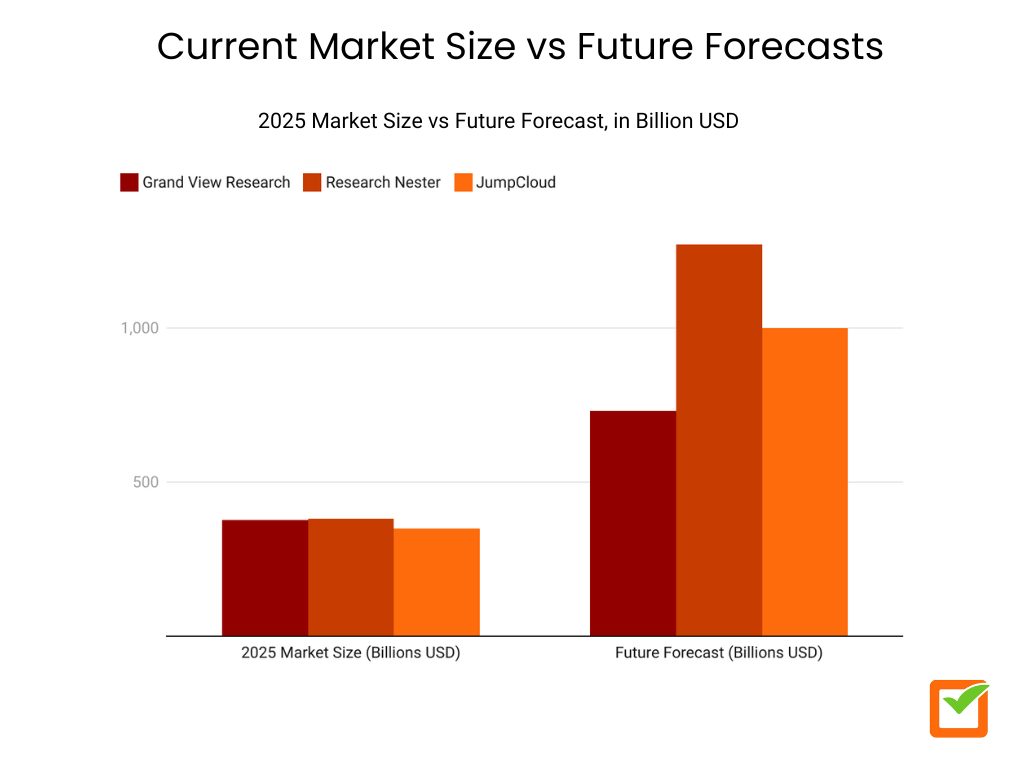

The market estimations for MSPs differ primarily because methodologies and scopes vary. Some studies include all managed services (such as BPO or data center outsourcing), while others focus solely on IT MSPs. Additionally, some models channel-delivered revenue versus total end-customer spend. Time horizons and currency assumptions also differ, so expect variance of ~10-15% across sources.

Now, let’s look at current market sizes and estimations through multiple lenses:

- According to Grand View Research, the market is $377.49 billion (2025) and is forecast to be $731.08 billion by 2030.

- Research Nester has a similar 2025 valuation of $380.33 billion and estimates a market value of $1.27 trillion by 2035.

Other sources also show calculations exceeding $1 trillion by 2033 (12.9% CAGR). If we view the channel partner lens, focusing on partner-delivered revenue, global IT managed services are expected to grow ~13% year-over-year by the end of 2025.

Here’s an overview of the difference between three major information sources:

Using Grand View Research’s CAGR (14.1% from 2025), our calculation implies ~$561B by 2028, which is consistent with “> $500B by 2028” expectations across the industry.

On the demand side, 76% of organizations plan to increase MSP investment over the next 12 months (up from 67% six months prior), reinforcing the growth outlook from market models (Source).

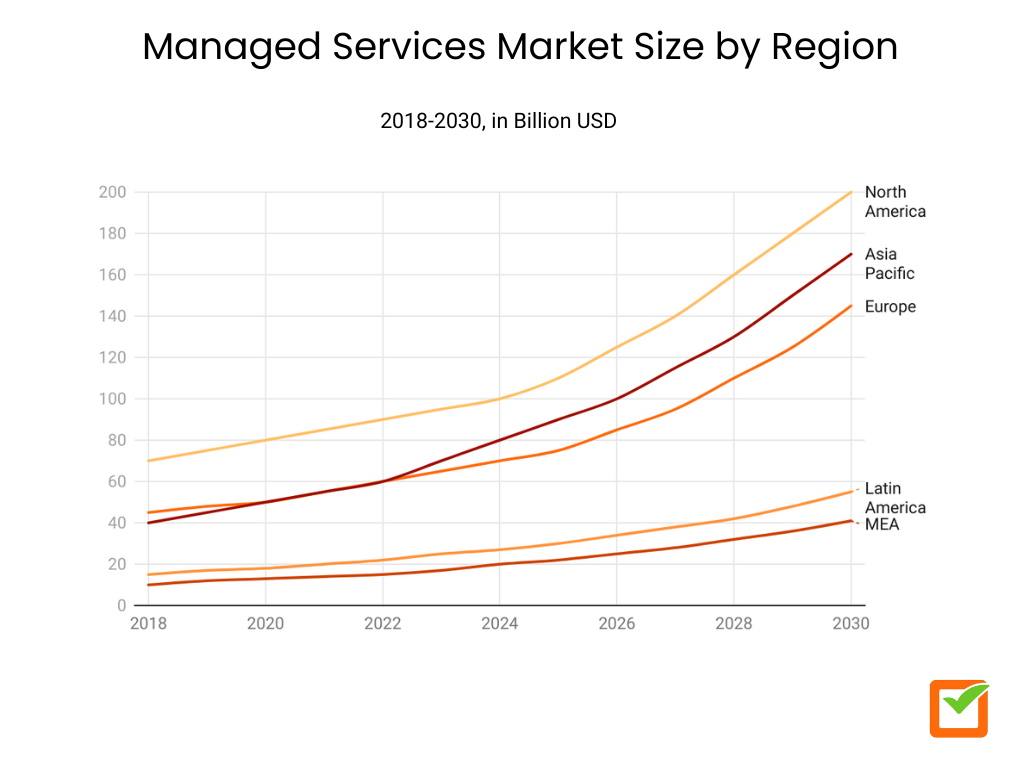

Regional Market Insights: Where is growth the strongest?

Let’s break these MSP statistics down (Source):

- North America: Still the heavyweight. The market is projected to grow from roughly $70 billion (2018) to over $ 200 billion by 2030. Growth is steady rather than explosive, but the region maintains the most significant absolute spend.

- Europe: Reliable climber. From about $45 billion (2018) to nearly $145 billion by 2030, with solid momentum, though not as fast as the Asia Pacific. Substantial compliance and mature buyers help maintain consistent demand.

- Asia Pacific (APAC): The sprinter. Rising from ~$40 billion (2018) to ~$170 billion by 2030, APAC more than quadruples, driven by rapid digitalization, cloud adoption, and expanding enterprise IT needs.

- Latin America & Middle East/Africa: Smaller bases, clear uptrends. Latin America grows from ~$15 billion > ~$55 billion, and MEA from ~$10 billion > ~$41 billion by 2030. While their totals are modest next to the big three, adoption is accelerating year over year.

Your takeaway should be that North America leads in total dollars, APAC leads in growth rate, Europe holds steady, and LatAm/MEA are rising from more modest starting points.

Core Services & Segmentation Trends: What Do Buyers Actually Buy?

1. Security has become the center of gravity

Mid-market enterprises now view MSPs as security partners, not just help desks: 85% rely on MSPs for security, and 92% say they’ll pay more (up to ~25%) for advanced support, such as 24/7 coverage and tighter tool integration (Source).

Expectations have also increased: 84% of customers now expect their MSP to manage cybersecurity infrastructure, or even the entire IT estate, rather than just a few point tools (Source). Under the hood, the managed security services (MSS) segment itself is sizable and growing: ~$38.3B in 2025, with cloud-delivered models already the norm (cloud holds ~72.3% share as of 2024) and MDR emerging as a leading service line.

2. Cloud & multi-cloud management stays core to renewals

Operations, cost optimization, identity, and multi-cloud orchestration are the day-to-day services that customers continue to buy and expand with their MSPs. JumpCloud’s 2025 outlook indicates steady demand tied to hybrid work and SaaS sprawl, while dedicated “cloud managed services” are projected to reach approximately $141B in 2025 and continue to rise as enterprises shift from asset ownership to outcome-based operations.

3. Legacy “managed” categories still matter in the spend mix

Despite the security/cloud spotlight, large pools of managed spend remain in long-standing outsourcing categories. Managed data center services accounted for more than 16% of total managed services revenue in 2024, underscoring the ongoing demand for hybrid infrastructure. And within “managed information services,” business process outsourcing (BPO) has historically commanded a significant slice, ~37.4% in 2022, a helpful reminder that many “managed” dollars still flow to operational outsourcing, alongside IT-specific MSP work.

4. Fast-growing & emerging services to watch

- Co-managed SOC, zero-trust, and identity-centric security are now table stakes in enterprise deals and expansions.

- AI-assisted operations, applying AI to monitoring, reporting, and remediation to cut noise and MTTR (Source).

- IoT/edge & vertical specialization, rising as buyers look for industry-aware partners who can secure distributed environments.

- Buyer proof points, customers confirm why they renew: increased IT effectiveness (54%), easier admin work (43%), strong support (41%), up-to-date tech (40%), and better UX (38%), all prioritized over “cost” versus late-2024 (Source).

Why do these MSP statistics matter for MSPs?

Security will keep winning the budget conversation (buyers will pay more for it), while cloud/multi-cloud management and automation keep relationships sticky and margin-positive over time. Pair security-first offers (co-managed SOC, MDR, zero trust) with platform consolidation and identity-led operations to meet what customers actually value in 2025.

Bonus: Organizations love outcomes, but they still worry about MSP security and UX friction. 44% report concerns about how MSPs manage security, 88% flag shadow-IT risk, and UX friction is a top reason some resist MSP-led security (38%), alongside cost (35%) and compatibility gaps (21%) (Source). Build packages that emphasize transparent security posture, shadow-IT discovery, and low-friction controls (e.g., passwordless, risk-based MFA).

Key Industry Trends for 2025

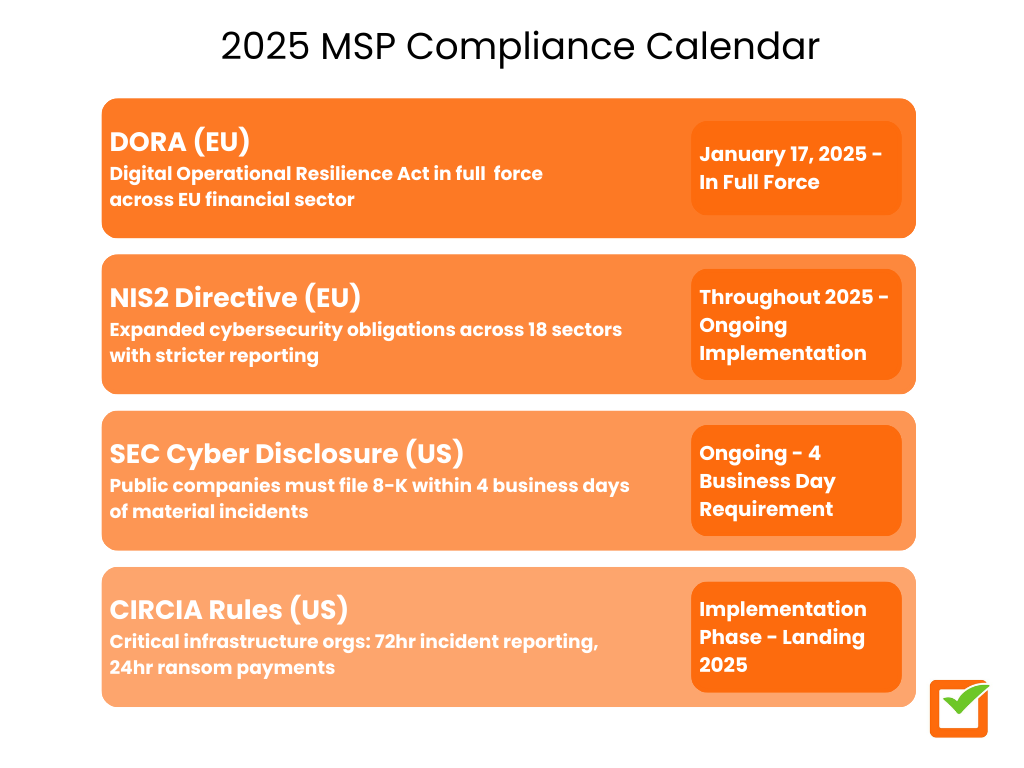

Compliance takes precedence in the RFP

Regulatory timelines are now driving selection criteria and SLAs, especially in finance and critical infrastructure. DORA is in force across the EU financial sector as of January 17, 2025, raising the bar on ICT risk, incident reporting, testing, and third-party oversight (read: MSP assurance).

In parallel, the NIS2 Directive broadens cyber obligations across 18 sectors (more entities fall in scope, with stricter reporting and penalties), which many buyers will expect MSPs to operationalize.

In the U.S., SEC cyber disclosure rules require public companies to file an 8-K within four business days of deeming an incident material, thereby tightening the timelines for detection, forensics, and executive communications that MSPs often help meet. And CIRCIA rules are landing: covered critical-infrastructure orgs will need to report within 72 hours (incidents) and 24 hours (ransom payments), pushing providers to formalize incident playbooks and evidence capture.

As a result, packaging compliance operations (including reporting workflows, tabletop testing, evidence logging, and board-ready reporting) become a competitive differentiator in 2025.

Data sovereignty becomes a buying trigger

Large buyers (public sector, regulated industries) are actively testing sovereign-cloud options and data-boundary controls. AWS has committed €7.8 billion to launching an EU-operated European Sovereign Cloud by the end of 2025, with the first region slated for Brandenburg, Germany. Microsoft completed Phase 3 of its EU Data Boundary in Feb 2025 (keeping support and professional-services data in-region). Google Cloud expanded its Data Boundary and sovereignty controls in May 2025.

So, you can expect more RFP language regarding key custody, data location attestations, and “admin in region.” MSPs that can prove end-to-end locality (including logs/support data) win more enterprise bids. (Context: European policy debate on digital sovereignty and hyperscaler options keeps intensifying.)

Procurement shifts to hyperscaler marketplaces

Enterprise software buying is flowing through AWS, Azure, and Google marketplaces because customers can burn down pre-committed cloud spend via private offers and multiparty private offers. Analysts now project $85 billion in marketplace sales by 2028, up from earlier estimates of $45 billion.

Policy changes also matter: AWS has tightened its discount/commit rules, so certain private-pricing/EDP benefits apply only when SaaS runs 100% on AWS, affecting how MSPs and ISVs architect hosted services. AWS also introduced multi-currency private offers and non-US disbursements, making cross-border deals easier.

This means that to accelerate deals, align your catalog and co-sell motions with marketplace programs, and ensure that hosting/architecture won’t disqualify customers from commitment-burn or discount tiers.

FinOps governance rises (beyond “cost cutting”)

2025 FinOps data shows the discipline maturing into governance and chargeback, not just “turn things off.” Teams commonly report to a CTO (43%), a CIO (24%), or a CFO (17%), reflecting a tighter alignment between engineering and finance. Commentary on the State of FinOps 2025 highlights a shift toward policy-driven optimization, unit economics, and cross-team accountability.

So, buyers want MSPs who can establish cost policies (budgets, guardrails, RBAC), unit-cost dashboards, and demonstrate a credible path from waste reduction to predictable cloud margins.

Incident-readiness gets quantified

Threat data in 2025 is sobering and is changing how customers evaluate providers. Verizon DBIR 2025 reports that ransomware is present in 44% of breaches (+37% YoY), with edge-device vulnerability exploitation increasing nearly 8 times, and a median remediation time of 32 days. The median ransom amount fell to $115,000 as more victims refuse to pay.

So, expect RFP questions about immutable backups, containment SLAs, evidence preservation, and time-to-detect/contain. Bring hard numbers (MTTD/MTTR by incident type) to the table.

AI goes from the slide to the delivery layer

MSP-relevant platforms are now shipping GA AI features that reshape ops: Microsoft Copilot for Security (GA since April 2024) extends into Intune and endpoint workflows (GA updates July 2025).

ServiceNow continues to expand Now Assist and is doubling down on AI agents (organic growth plus the Moveworks acquisition announced in 2025. Atlassian Rovo rolled out across Premium/Enterprise from April 2025, bringing AI search/agents directly into developer and IT work.

We can conclude that buyers will increasingly ask, “Where does AI save time in our tickets, changes, and investigations, proven, in production?” Be prepared to demonstrate agentic workflows (triage, summarization, and change risk analysis) and explain how they contribute to measurable SLA/MTTR improvements.

ESG reporting starts touching MSP contracts

With the EU Data Act (applicable as of September 12, 2025) and ongoing CSRD roll-out/adjustments, large enterprises are extending supplier (including MSP) requirements regarding data portability, switching, and Scope 3 disclosures. First-wave CSRD filers begin reporting on FY2024 data in 2025, even as an Omnibus proposal seeks to simplify elements going forward.

This means that RFPs increasingly ask for data-portability terms, carbon-footprint data, and audit-ready evidence; ensure your contracts and telemetry support these requirements.

Challenges MSPs Face in 2025

Here are the hard truths our team is seeing in 2025, presented concisely and with fresh sources linked directly next to each statistic:

- Security scrutiny is surging. We see that 77% of MSP leaders report increased client scrutiny of their own security; more than 80% have added specialist security hires, and 78% have boosted security capability spending (Source).

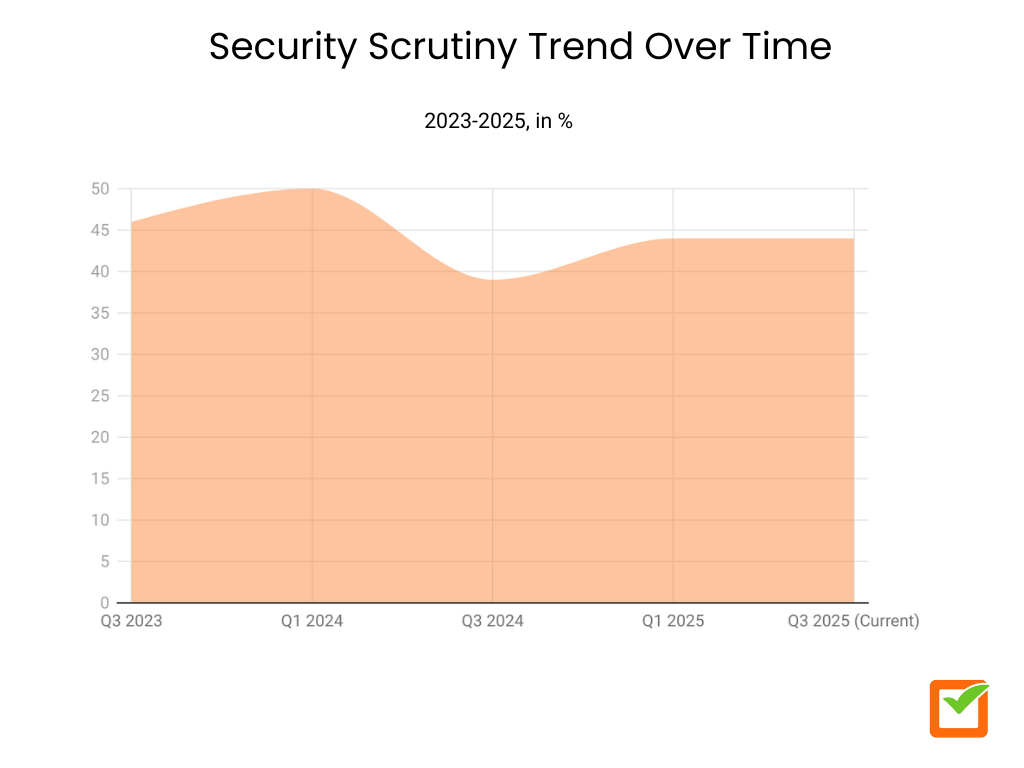

- Buyers still worry about MSP security. Concern sits at 44% today (up from 39% in Q3 ’24, 50% in Q1 ’24, and 46.2% in 2023), and 88% of admins flag shadow-IT risk.

- Burnout is now an operational constraint. Sixty % of IT/MSP professionals report moderate-to-high burnout, and 78% say stress hinders upskilling; quality will suffer without workload and staffing fixes (Source).

- Tool sprawl slows response. Half of MSPs juggle 10 or more tools, 44% lack real-time visibility, and 74% say that separate server monitoring contributes to sprawl (Source).

- Compliance clocks are real. Public companies must disclose material cyber incidents within four business days under SEC rules, and DORA now applies (since January 17, 2025), with tightened ICT-third-party obligations across EU financial services (Source).

- Supply-chain and ransomware risk is elevated. Verizon’s DBIR shows that third-party involvement has doubled to 30%, and ransomware appears in 44% of breaches, with a median ransom of around US$115,000 (Source).

- Cyber-insurance prerequisites are tightening. Underwriters increasingly expect EDR and MFA, and organizations that test incident-response plans see 13% fewer breach-driven claims.

- Licensing costs are biting. Only 7% of orgs spend <10% of budget on licensing now, while 39% spend 26-50%, up sharply versus late-2024.

- Upskilling pressure is rising. The most popular way to close the skills gap is training existing staff, with plans to upskill, climbing from 59% (2024) to 66% (2025) (Source).

Best Practices & Strategic Recommendations: What to Do Now?

For MSPs

| Action | Why now (outcome) | Proof |

|---|---|---|

| Consolidate your stack | Have fewer tools: real-time visibility, faster MTTR, less swivel-chair work, and burnout. | Burnout & tool sprawl trends. |

| Make security your front door | Buyers pay for integrated outcomes (co-managed SOC, 24/7, zero-trust). | 92% willing to pay up to 25% more. |

| Institutionalize well-being | Rotations + automation protect quality and retention under 24/7 demand. | 60% report burnout. |

| Operational maturity benchmarks | Steer pricing/packaging with data (retention ≥76%, ARPU ≥$250, recurring revenue >51%). | ScalePad 2025 MSP benchmarks. |

| Build AI capability (defense + ops) | AI-aware security + AI-assisted monitoring/remediation cuts noise and MTTR. | AI risk & ops adoption. |

For IT Buyers (CIOs/CTOs)

| Action | Why now (outcome) | Proof |

|---|---|---|

| Vet security depth first | Verify SOC, 24/7 IR, identity controls, and supply-chain coverage, not just tool lists. | Security expectations and scrutiny. |

| Demand clarity in SLAs & pricing | Tie fees to uptime, MTTR, and security outcomes; require reporting on stack consolidation. | Burnout/sprawl impact on outcomes. |

| Leverage co-managed models | Keep strategy in-house; outsource 24/7 operations and Tier 1/2 support to boost resilience and reduce burnout. | Buyer’s willingness to pay for advanced support. |

| Use maturity benchmarks in governance | Ask providers to report quarterly on retention, ARPU quality mix, and the share of recurring revenue. | ScalePad 2025 MSP benchmarks. |

Conclusion

The 2025 MSP landscape is larger and faster-moving, with an estimated value of approximately $380 billion today, on a trajectory to reach $700 billion by 2030, and more security-centric than ever. With buyers expecting end-to-end coverage and 24/7 resilience, and with staff burnout and tool sprawl being real, winners will be the MSPs that consolidate platforms, lead with security outcomes, and apply AI pragmatically to shrink MTTR and raise service quality. For IT leaders, co-managed models and outcome-based SLAs are the fastest path to resilience in 2025.

References

- Amazon (About Amazon EU). AWS Plans to Invest €7.8 Billion into the AWS European Sovereign Cloud. Accessed on August 28, 2025. https://www.aboutamazon.eu/news/aws/aws-plans-to-invest-7-8-billion-into-the-aws-european-sovereign-cloud

- Amazon Web Services. AWS Marketplace Offers New Currencies & Non-US Bank Accounts for Disbursement. Accessed on August 28, 2025. https://aws.amazon.com/about-aws/whats-new/2024/10/aws-marketplace-offers-new-currencies-non-us-bank-accounts-disbursement/

- American Hospital Association. CISA Releases Proposed Rule on Cyber Incident Reporting. Accessed on August 28, 2025. https://www.aha.org/news/headline/2024-03-27-cisa-releases-proposed-rule-cyber-incident-reporting

- Atlassian. Rovo: Unlock Organizational Knowledge with GenAI. Accessed on August 28, 2025. https://www.atlassian.com/software/rovo

- Auvik. IT Trends 2025: Industry Report (PDF). Accessed on August 28, 2025. https://www.auvik.com/wp-content/themes/auvik/downloads/Auvik-IT-Trends-Report-2025.pdf

- Canalys. MSP Trends and Predictions 2025 — Executive Summary. Accessed on August 28, 2025. https://canalys.com/insights/msp-trends-2025-es

- CIO Dive. AWS Tightens Up SaaS Marketplace Discount Policy. Accessed on August 28, 2025. https://www.ciodive.com/news/aws-tightens-cloud-saas-vendor-marketplace-discounts/740123/

- CyberSmart. The CyberSmart MSP Survey 2024. Accessed on August 28, 2025. https://cybersmart.co.uk/the-cybersmart-msp-survey-2024/

- Davis Wright Tremaine. Regulatory Reset? U.S. Cyber Incident Reporting Rules Face Congressional Scrutiny. Accessed on August 28, 2025. https://www.dwt.com/blogs/privacy–security-law-blog/2025/03/cisa-sec-cyber-incident-reporting-rules-congress

- ESMA. Digital Operational Resilience Act (DORA). Accessed on August 28, 2025. https://www.esma.europa.eu/esmas-activities/digital-finance-and-innovation/digital-operational-resilience-act-dora

- European Commission. Data Act. Accessed on August 28, 2025. https://digital-strategy.ec.europa.eu/en/policies/data-act

- European Commission. NIS2 Directive: Securing Network and Information Systems. Accessed on August 28, 2025. https://digital-strategy.ec.europa.eu/en/policies/nis2-directive

- FinOps Foundation. The State of FinOps. Accessed on August 28, 2025. https://data.finops.org/library

- Google Cloud. Google Advances Sovereignty, Choice, and Security in the Cloud. Accessed on August 28, 2025. https://cloud.google.com/blog/products/identity-security/google-advances-sovereignty-choice-and-security-in-the-cloud

- Grand View Research. Edge Security Market Size & Share | Industry Report, 2033. Accessed on August 28, 2025. https://www.grandviewresearch.com/industry-analysis/edge-security-market-report

- Grand View Research. Managed Services Market Size, Share & Trends Analysis Report (2025–2030). Accessed on August 28, 2025. https://www.grandviewresearch.com/industry-analysis/managed-services-market

- Insurance Business America. Revealed — Incident Response Planning Linked to Fewer Cyber Insurance Claims. Accessed on August 28, 2025. https://www.insurancebusinessmag.com/us/news/breaking-news/revealed–incident-response-planning-linked-to-fewer-cyber-insurance-claims-547642.aspx

- IT Pro. Growing Toil and Talent Gaps Are Driving a Rise in “IT Generalists”. Accessed on August 28, 2025. https://www.itpro.com/business/business-strategy/toil-and-talent-gaps-driving-it-generalist

- IT Pro. MSPs Are Burned Out and Overworked as Tool Sprawl and IT Complexity Grows—But There’s Light on the Horizon. Accessed on August 28, 2025. https://www.itpro.com/business/business-strategy/msps-are-burned-out-and-overworked-as-tool-sprawl-and-it-complexity-grows-but-theres-light-on-the-horizon

- IT Pro. MSPs Emerge as Key Security Partners for Mid-Market Enterprises. Accessed on August 28, 2025. https://www.itpro.com/security/msps-emerge-as-key-security-partners-for-mid-market-enterprises

- IT Pro. Pressure Mounts on MSPs as Enterprises Flock to Managed Cybersecurity Services. Accessed on August 28, 2025. https://www.itpro.com/security/pressure-mounts-on-msps-as-enterprises-flock-to-managed-cybersecurity-services

- JumpCloud. Build The Ideal MSP: Addressing Key Challenges and Opportunities (PDF). Accessed on August 28, 2025. https://jumpcloud.com/wp-content/uploads/2025/02/Build-The-Ideal-MSP-Addressing-Key-Challenges-and-Opportunities.pdf

- JumpCloud. Key MSP Statistics and Trends to Know for 2025. Accessed on August 28, 2025. https://jumpcloud.com/blog/msp-statistics-trends

- Microsoft. Microsoft Completes Landmark EU Data Boundary, Offering Enhanced Data Residency and Transparency. Accessed on August 28, 2025. https://blogs.microsoft.com/on-the-issues/2025/02/26/microsoft-completes-landmark-eu-data-boundary-offering-enhanced-data-residency-and-transparency/

- Microsoft Security Blog. Microsoft Copilot for Security Is Generally Available on April 1, 2024 (with New Capabilities). Accessed on August 28, 2025. https://www.microsoft.com/en-us/security/blog/2024/03/13/microsoft-copilot-for-security-is-generally-available-on-april-1-2024-with-new-capabilities/

- Microsoft Tech Community. Partner Blog: Maximizing Partner Success with Marketplace Changes. Accessed on August 28, 2025. https://techcommunity.microsoft.com/blog/partnernews/partner-blog–maximizing-partner-success-with-marketplace-changes/4260158

- Mordor Intelligence. Managed Security Services Market Size, Outlook, Trends & Growth (to 2030). Accessed on August 28, 2025. https://www.mordorintelligence.com/industry-reports/security-managed-services-market

- MSSP Alert. JumpCloud Strategist Sees IT Teams Claw Back Control from MSPs. Accessed on August 28, 2025. https://www.msspalert.com/news/jumpcloud-strategist-sees-it-teams-claw-back-control-from-msps

- OECD. Getting Skills Right: Bridging Talent Shortages in Tech (PDF). Accessed on August 28, 2025. https://www.oecd.org/content/dam/oecd/en/publications/reports/2024/09/bridging-talent-shortages-in-tech_983d7ca6/f35da44f-en.pdf

- PwC US. What US Companies Need to Know about CSRD. Accessed on August 28, 2025. https://www.pwc.com/us/en/services/esg/library/eu-corporate-sustainability-reporting-directive.html

- Research Nester. Managed Services Market Size, Share & Forecast Report 2026–2035. Accessed on August 28, 2025. https://www.researchnester.com/reports/managed-services-market/6742

- ScalePad. 2025 MSP Business Trends Report. Accessed on August 28, 2025. https://www.scalepad.com/2025-msp-trends-report/

- Security Boulevard. New Data Confirms: 85% of Mid-Market Orgs Now Depend on MSPs for Security. Accessed on August 28, 2025. https://securityboulevard.com/2025/08/new-data-confirms-85-of-mid-market-orgs-now-depend-on-msps-for-security/

- ServiceNow. Expansion of GenAI Capabilities (Press). Accessed on August 28, 2025. https://www.servicenow.com/company/media/press-room/genai-capabilities-expansion.html

- TechRadar Pro. The Path to European Data Sovereignty. Accessed on August 28, 2025. https://www.techradar.com/pro/the-path-to-european-data-sovereignty

- TechTarget (SearchCloudComputing). By the Numbers: How Upskilling Fills the IT Skills Gap. Accessed on August 28, 2025. https://www.techtarget.com/searchcloudcomputing/infographic/By-the-numbers-How-upskilling-fills-the-IT-skills-gap

- U.S. Securities and Exchange Commission. SEC Adopts Rules on Cybersecurity Risk Management, Strategy, Governance, and Incident Disclosure by Public Companies. Accessed on August 28, 2025. https://www.sec.gov/newsroom/press-releases/2023-139

- USU. Key Takeaways from the State of FinOps 2025 Report. Accessed on August 28, 2025. https://www.usu.com/en-us/blog/state-of-finops-2025

- Verizon. 2025 Data Breach Investigations Report — News Release. Accessed on August 28, 2025. https://www.verizon.com/about/news/2025-data-breach-investigations-report